Why Sales Estimates Are Unrealistic

The passage of time is information. Why do we ignore it?

We are all familiar with the oldest profession.1 This essay addresses the second oldest profession—selling.

Optimism

Not long after the creation of professional salespeople came the corporate creation, the “sales organization.” Soon there were leads, deals, and other terms beloved in the world of business development and reviled in the world of software engineering.

These leads progressed from initial conversations to signatures on dotted lines, passing through stages that became known as “the sales funnel.” Every marketing team attempts to estimate the revenue their current sales funnel will produce, and frequently, their estimates are overly optimistic.

Soon, no one trusts the sanguine salespeople whose relentlessly rosy projections are perceived as some mixture of optimism and delusion.

So why, despite the profusion of software for managing sales funnel information are we constantly overestimating?

Math

This misplaced optimism is because every piece of funnel-focused software does, essentially, the same thing:

- Calculate the probability of a deal closing, given the stage of the funnel in which it sits

- Count the number of deals sitting in each stage

- Ask the user for the projected revenue if a deal closes

- Multiply the values in #1, #2, and #3 to calculate an expected value

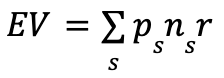

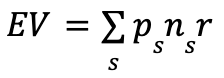

Adding a bit of mathematical formality can help. Let the probability of a deal closing from stage s be represented as ps . Let the number of deals in stage s be denoted by ns. Let the expected revenue for a given deal to be defined as r. Expected revenue is calculated as:

Most statistics textbooks would bless this type of thinking. Unfortunately, this is deeply, profoundly wrong.

Reality

The probability of a deal closing from a given stage of the sales funnel is ps at one and only one moment in this history of that deal…the moment it enters that stage.2 We all understand this intuitively. Imagine that 50% of all proposals sent to a client yield a closed deal. Do we really believe there is no difference between those odds on the day that proposal is sent and when no response has been forthcoming after three follow-up inquiries over the next month?

With every passing moment, deals wither on the vine. The expected value falls. Repeated outreach and follow-up to maintain a deal’s momentum are an acknowledgement of this reality. Why is the math so far behind?

The passage of time is information. Why do we ignore it?

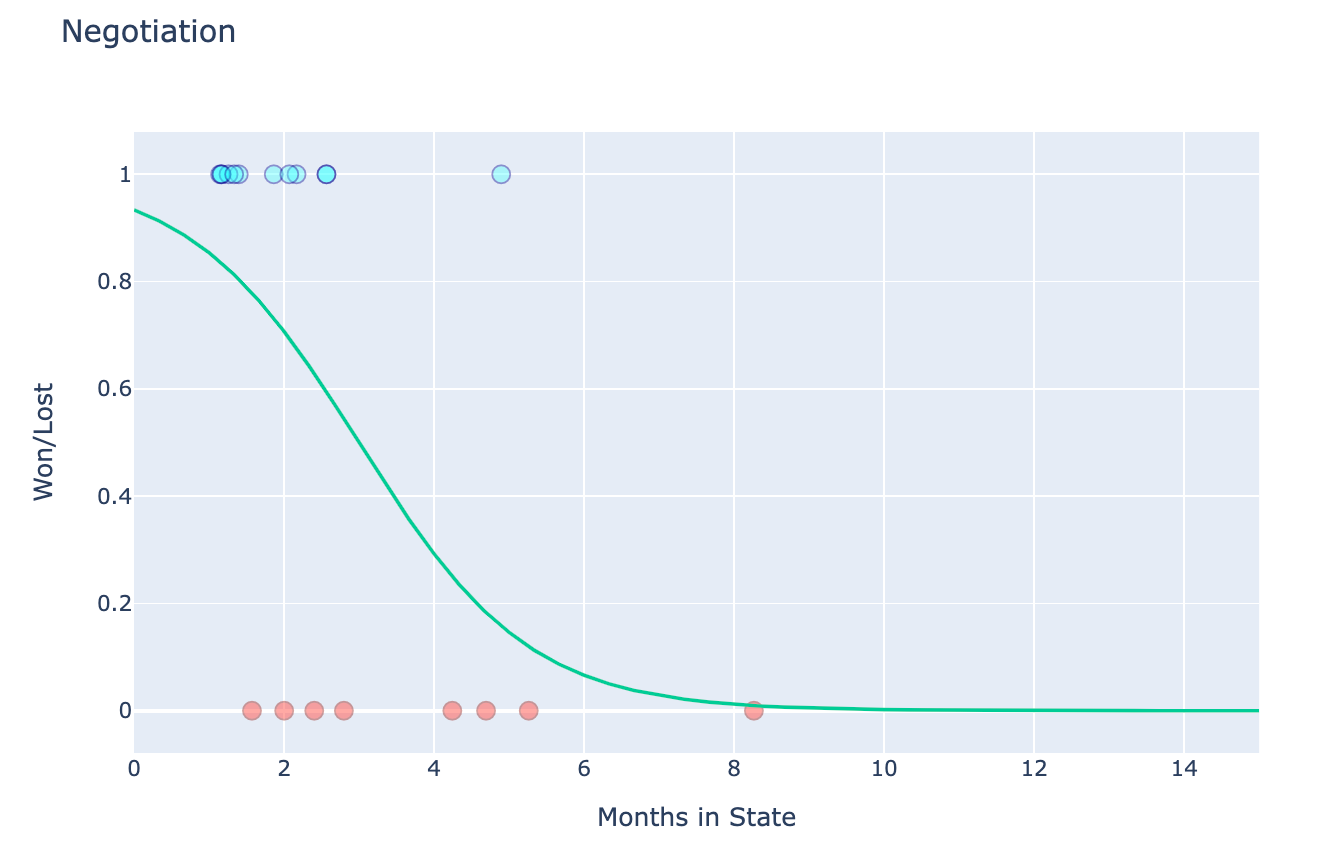

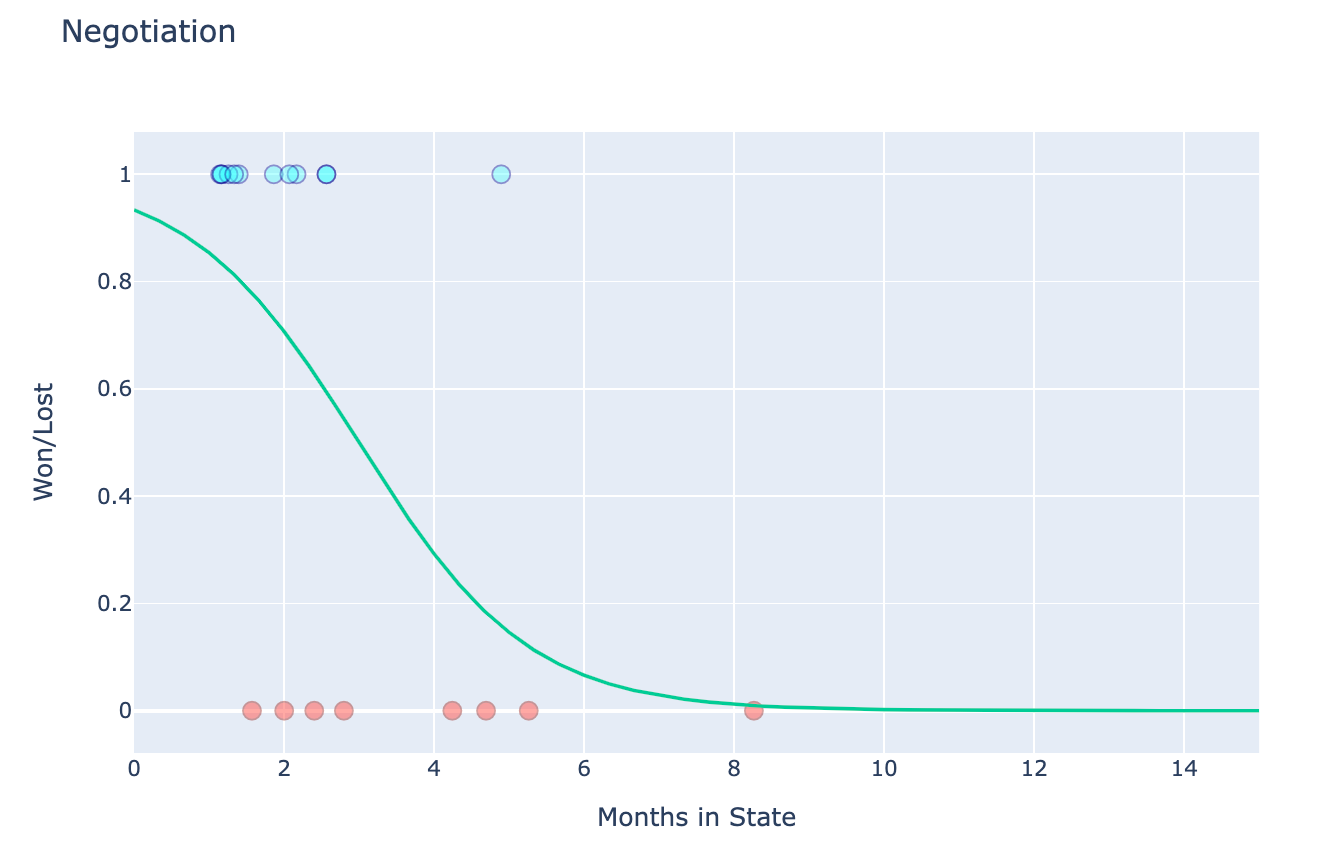

Below is an illustration of all of AEs deals that reach the “negotiation” stage. We’ve sent a contract to the client, and now, we’re ironing out the details. Most of the time, a deal that reaches this stage, will ultimately close as evidenced by all those blue dots up near the upper-left corner in the figure (there are 50+ all bunched up there). Unfortunately, sometimes, we cannot come to terms with a potential client.

Initially, when negotiations begin, our odds likely exceed 90%. But the longer the negotiation lingers, the less likely we are to close. Intuitively, we all grasp this idea, and yet existing software often ignores it altogether. Why? Perhaps sigmoid functions cause great consternation and flashbacks to university coursework. More likely, we’d prefer to ignore the unpleasant reality that, with each passing day, we find ourselves slip slidin’ away from our sale.

Solution

If time is information, then estimations of profits, and everything else that emerges from a sales funnel (e.g. staffing requirements) need to include not only the stage in the funnel, but how long the deal has been there.

It’s simple really. Model a sigmoidal decay curve3 based on recent historical data in each stage. Use that decay curve to estimate, at any moment, the probability each deal closes. Calculate expected value using that probability for each deal in the funnel. Update as each passing day (or hour) elapses.

Optimism is good. Realism is better. Confidence yields justified optimism.

1 Some in different ways than others, admittedly.

2 The mathematically-inclined might prefer to define this moment as t=0.

3 I realize some of you probably just, “in exactly what world is that simple?” But then, this is why there are data scientists. Fitting curves is kinda what they do… among other interests topological, morphological, and/or ontological.

P.S. - We’re building a tool at AE called ProphetFunnel that implements this logic for our own sales funnel–and possibly yours if we decide to invest in it as Primetime Skunkworks. We’d rather see through a mathematical lens than the rose-colored glasses of over-optimistic salespeople! Wouldn’t you?

No one works with an agency just because they have a clever blog. To work with my colleagues, who spend their days developing software that turns your MVP into an IPO, rather than writing blog posts, click here (Then you can spend your time reading our content from your yacht / pied-a-terre). If you can’t afford to build an app, you can always learn how to succeed in tech by reading other essays.

Why Sales Estimates Are Unrealistic

The passage of time is information. Why do we ignore it?

We are all familiar with the oldest profession.1 This essay addresses the second oldest profession—selling.

Optimism

Not long after the creation of professional salespeople came the corporate creation, the “sales organization.” Soon there were leads, deals, and other terms beloved in the world of business development and reviled in the world of software engineering.

These leads progressed from initial conversations to signatures on dotted lines, passing through stages that became known as “the sales funnel.” Every marketing team attempts to estimate the revenue their current sales funnel will produce, and frequently, their estimates are overly optimistic.

Soon, no one trusts the sanguine salespeople whose relentlessly rosy projections are perceived as some mixture of optimism and delusion.

So why, despite the profusion of software for managing sales funnel information are we constantly overestimating?

Math

This misplaced optimism is because every piece of funnel-focused software does, essentially, the same thing:

- Calculate the probability of a deal closing, given the stage of the funnel in which it sits

- Count the number of deals sitting in each stage

- Ask the user for the projected revenue if a deal closes

- Multiply the values in #1, #2, and #3 to calculate an expected value

Adding a bit of mathematical formality can help. Let the probability of a deal closing from stage s be represented as ps . Let the number of deals in stage s be denoted by ns. Let the expected revenue for a given deal to be defined as r. Expected revenue is calculated as:

Most statistics textbooks would bless this type of thinking. Unfortunately, this is deeply, profoundly wrong.

Reality

The probability of a deal closing from a given stage of the sales funnel is ps at one and only one moment in this history of that deal…the moment it enters that stage.2 We all understand this intuitively. Imagine that 50% of all proposals sent to a client yield a closed deal. Do we really believe there is no difference between those odds on the day that proposal is sent and when no response has been forthcoming after three follow-up inquiries over the next month?

With every passing moment, deals wither on the vine. The expected value falls. Repeated outreach and follow-up to maintain a deal’s momentum are an acknowledgement of this reality. Why is the math so far behind?

The passage of time is information. Why do we ignore it?

Below is an illustration of all of AEs deals that reach the “negotiation” stage. We’ve sent a contract to the client, and now, we’re ironing out the details. Most of the time, a deal that reaches this stage, will ultimately close as evidenced by all those blue dots up near the upper-left corner in the figure (there are 50+ all bunched up there). Unfortunately, sometimes, we cannot come to terms with a potential client.

Initially, when negotiations begin, our odds likely exceed 90%. But the longer the negotiation lingers, the less likely we are to close. Intuitively, we all grasp this idea, and yet existing software often ignores it altogether. Why? Perhaps sigmoid functions cause great consternation and flashbacks to university coursework. More likely, we’d prefer to ignore the unpleasant reality that, with each passing day, we find ourselves slip slidin’ away from our sale.

Solution

If time is information, then estimations of profits, and everything else that emerges from a sales funnel (e.g. staffing requirements) need to include not only the stage in the funnel, but how long the deal has been there.

It’s simple really. Model a sigmoidal decay curve3 based on recent historical data in each stage. Use that decay curve to estimate, at any moment, the probability each deal closes. Calculate expected value using that probability for each deal in the funnel. Update as each passing day (or hour) elapses.

Optimism is good. Realism is better. Confidence yields justified optimism.

1 Some in different ways than others, admittedly.

2 The mathematically-inclined might prefer to define this moment as t=0.

3 I realize some of you probably just, “in exactly what world is that simple?” But then, this is why there are data scientists. Fitting curves is kinda what they do… among other interests topological, morphological, and/or ontological.

P.S. - We’re building a tool at AE called ProphetFunnel that implements this logic for our own sales funnel–and possibly yours if we decide to invest in it as Primetime Skunkworks. We’d rather see through a mathematical lens than the rose-colored glasses of over-optimistic salespeople! Wouldn’t you?